HedgeTrade Weekly Insights - Hallo sahabat

Berita Terkini, Pada Artikel yang anda baca kali ini dengan judul HedgeTrade Weekly Insights, kami telah mempersiapkan artikel ini dengan baik untuk anda baca dan ambil informasi didalamnya. mudah-mudahan isi postingan yang kami tulis ini dapat anda pahami. baiklah, selamat membaca.

Judul :

HedgeTrade Weekly Insightslink :

HedgeTrade Weekly Insights

HedgeTrade Weekly Insights

📣 Top News📊 Market Recap📈Charts👥Voices Hey Traders,

Your weekly update is ready! Enjoy! | | - The owner of the Fisco crypto exchange has sued Binance for allegedly facilitating the laundering of $9 million in stolen cryptocurrency, saying lax KYC policies on Binance's part allowed cybercriminals to convert stolen crypto from Zaif exchange to other crypto or cash.

- FinCen announced it will be updating AML and counter-terrorism finance rules just as Buzzfeed published an exhaustive rundown of how FinCen and big banks have been enabling large scale illicit fiat transactions.

- ETH 2.0 developer Danny Ryan announced that Spadina, a mainnet-configuration test network, will run parallel with Medalla in late September to test deposits and genesis ahead of mainnet launch.

- Kraken was approved by the Wyoming Banking Board in a historic vote to make the crypto-asset exchange a special purpose depository institution charter - essentially making it a state-chartered bank. The move also grants Kraken the freedom to transact across state borders in the US.

- BNP Paribas is working to establish real-time trade and settlement applications using Digital Asset smart contracts. The apps are set to service Asia Pacific markets including the Hong Kong Exchange.

- The Bank of Thailand announced its launch of a blockchain platform for government savings bond issuance. The central bank sold 50 billion Baht (~$1.6B) worth of saving bonds in a one week period.

| | | DeFi continues to take center stage as its characterization as a bubble becomes less accurate. The continued hype is fueling innovation in the crypto industry like never before. Bitcoin is meanwhile capturing the hearts of institutional investors as they figure out ways to enter the markets. The current bitcoin dominance rate is 57.70%, while bitcoin fear and greed and volatility are low. However, fear and greed and volatility are edging up in mainstream markets in relation to economic uncertainty, a possible resurgence of COVID-19, and a foreboding US election. Cautious market sentiment is evident with low volatility and fear/greed rates, with moderate downward price action over the past month seen across the board for Apple, the Dow, Gold, Bitcoin, Ethereum, and Chainlink. The images below depict the fear and greed index in traditional markets and bitcoin: | | | The interest in liquidity pools, staking and yield farming along with the hype surrounding these complex yet seemingly irresistible DeFi tokens, has brought a wealth of mainstream attention into the five-year-old DeFi industry. Nonfungible tokens (NFTs), for instance, are seeing considerable traction, as well as other DeFi ecosystems including prediction markets, lending services, crypto derivatives platforms, decentralized file storage, etc. | | | "Industry experts tend to believe that the current growth in DeFi is fueled by sophisticated investors with superior technical know-how. This may indicate that a peak of DeFi speculation driven by retail investors has yet to be reached." NASDAQ Contributor, Konstantin Richter

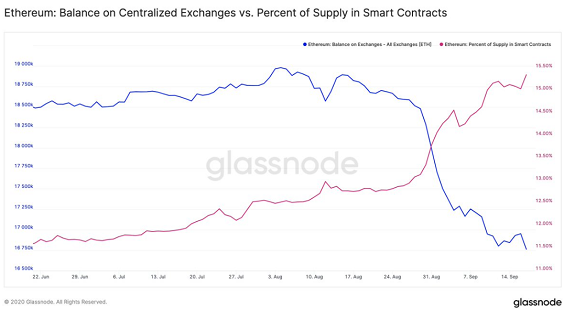

"Banked ETH losing to bankless ETH. This is insanely bullish for decentralization." - Ryan Sean Adams | | | Have a profitable week! -The HedgeTrade Team | | | |

Demikianlah Artikel HedgeTrade Weekly Insights

Sekianlah artikel HedgeTrade Weekly Insights kali ini, mudah-mudahan bisa memberi manfaat untuk anda semua. baiklah, sampai jumpa di postingan artikel lainnya.

Anda sekarang membaca artikel HedgeTrade Weekly Insights dengan alamat link https://beritaindoterkini2017.blogspot.com/2020/09/hedgetrade-weekly-insights_24.html

0 Komentar