🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree - Hallo sahabat

Berita Terkini, Pada Artikel yang anda baca kali ini dengan judul 🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree, kami telah mempersiapkan artikel ini dengan baik untuk anda baca dan ambil informasi didalamnya. mudah-mudahan isi postingan yang kami tulis ini dapat anda pahami. baiklah, selamat membaca.

Judul :

🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spreelink :

🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree

🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree

Happy Eid-Al-adha!

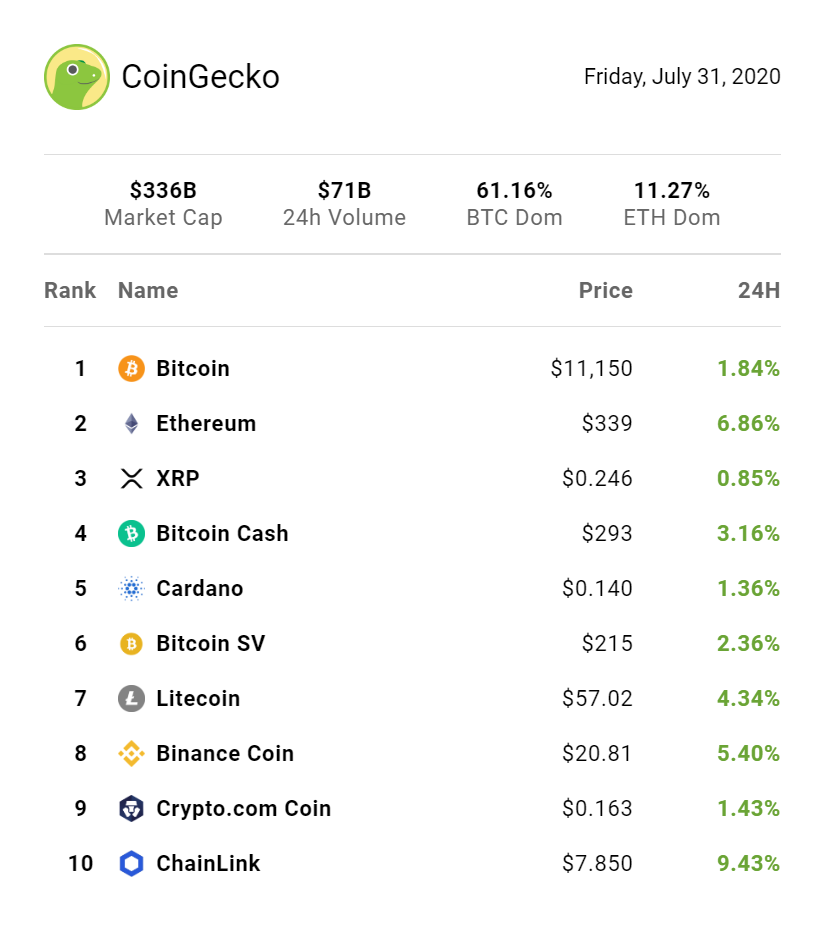

Happy Friday Geckos!

Quick word to our Muslim Geckos (because Geckos come from all over the world and from all cultures), we wish you Happy Eid al-adha!

Now this news isn't crypto related, but has ramifications that hit too close to home for all of us in this space - The US treasury has printed more money in the last 2 months alone than the entirety of its history.

Once you let that news sink in, make of it what you will.

(Editor: *is off to buy more Bitcoin before his fiat gets devalued further)

In other news, Consensys, an Ethereum focused tech firm, is now accepting applications to its new accelator program aimed at speeding up the adoption of Filecoin (FIL) within the Ethereum community.

The US SEC has also awarded a contract to a blockchain analystics firm specifically to trace transactions on the Binance Chain. Depending on how you look at it, it can be both good and bad news.

Ability to trace on-chain transactions may pave way to making Binance Chain more KYC-AML compliant, opening opportunities to legal and institution acceptance. On the other hand, the more privacy concerned among us may feel bothered by that yet another chain is being actively sleuthed over by Big Brother.

The last newsletter of this week has some juicy news! Specifically, we're looking at Elrond's Mainnet Launch and what's changed, EOS having to potentially undergo a huge political shift in its on chain governance, and the real farmers in the crypto space 😉.

Have a great weekend ahead!

| | |

|

|

|

| 24h Hot searches worldwide 👀 | | | Sponsored | | There's a better way to get in the crypto game! eToro lets you build a portfolio with the world's most popular cryptocurrencies, in minutes. They give you the research tools to make educated decisions, and they give you access to a host of experienced traders for advice and commentary. Plus, with just a click, you can allocate funds to a ready-made portfolio managed by professionals.

Discover the world's leading social trading platform. Get the app today!

|

|

|

|

| | Dial in on CoinGecko's new Podcast Episode, featuring Ivan Golovko!In this episode, Bobby Ong is joined by Ivan Golovko, Chief Marketing Officer at LTO Network where they talked about the LTO Network Token, fee burn mechanism proposal as well as the staking program for LTO Network. Bobby and Ivan also shared their thoughts on DeFi and Yield-farming.

Listen In | Google | Youtube | Apple | Spotify

| | Elrond Launches MainnetElrond has made the leap onto its mainnet and drastically reduced the token supply in the process.

As part of the transition, Elrond said total token supply had been drastically reduced from 20 billion to just 20 million. Rather than burning tokens, Elrond is using an exchange swap where 1,000 testnet ERD tokens translate into just one token on mainnet – called Elrond Gold. (Editor: Having started in 2018 and going through Binance's Launchpad in 2019. Elrond is relatively quick in rolling out a mainnet compared to other project with similar goals.)

CoinDesk

| | Block.one Starts Own Voting Proxy, commits 10% of EOS supply behind itEOS's parent company will vote for block producers using its huge reserve of 100 million EOS.

The proxy - named sub2.b1, which went live today, will allow Block.One to directly take part in EOS's DPoS Governance by voting on Block Producers.

Block.one has currently not selected which block producers it plans to vote for.

(Editor: This sounds all too familiar to that time when Justin Sun used close to 40% of Steem's supply belonging to Steemit to basically kick out all previous block producers who don't see eye to eye with him. Will the EOS community react the same way Steem's did? or is this a good thing to "wrestle back some control of the network"?)

CoinDesk

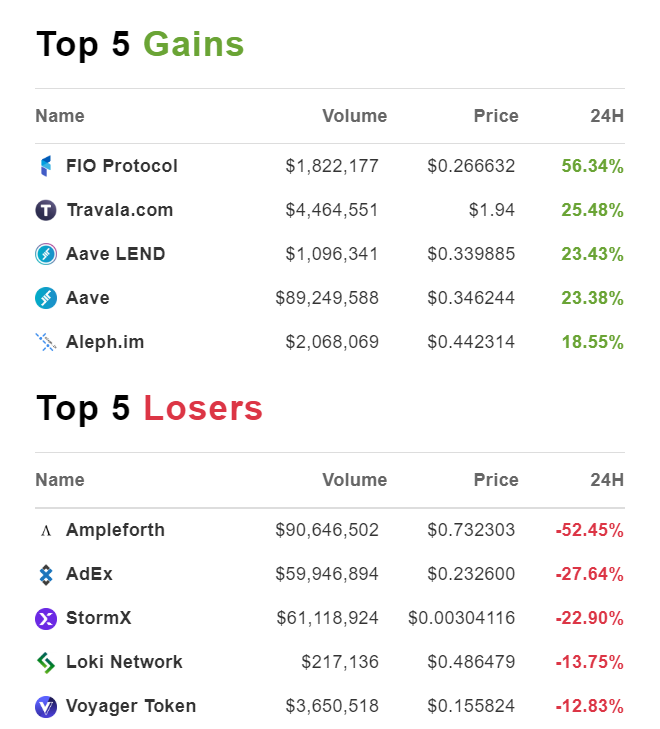

| | Ethereum mining rewards hit all-time highEthereum miners may be earning more now than they ever did, even during ETH's ATH at $1,400 a piece. While the block subsidy - new ETH minted as miner rewards, remains pretty much the same since February 2019. Gas fees on Ethereum is now higher than it's ever been.

More complex transactions needed for DeFi also mean users need to pay more gas on top of the high gas fees due to the network congestion. Unlike the mining ecosystem of Bitcoin, hash rates of Ethereum aren't at ATH, and data suggest that it doesn't seem to be increasing.

Translation = It may be easier and more profitable to mine ETH now that during the ICO hype, provided you have the right rig.

(Editor: DeFi may have birthed good memes, but the real farms are still mining farms. cc "editor" if that opinion made you angry.) Decrypt | | | This 3x Cobo Vault Could be yours!

Have some spare Candies to spend? Try your luck at a Brand new 3x Cobo Vault combo!

To stand a chance, you just need to: Purchase a voucher code using candies (or 10, because why not) Fill in a questionaire here after your purchase ??? Wait for the winner announcement!

This contest runs until the 20th August 2020, Grab your chance now!

*previously some vouchers were wrongly tagged as "expired" at purchase, the error has been fixed and you should see the vouchers in "active rewards". | |

|

|

|

| Margin TradingIt is a way of investing by borrowing money from a broker (or in crypto, an exchange or platform) to trade. The borrowing requires you to collateralize a minimum value of your own assets. If during the trade, the market moves negatively to your trade, a margin call will takes place so that your trade account retains the ratio of your borrowed funds to the collateralized assets. Learn about other Crypto terms here | | | |

|

|

|

Demikianlah Artikel 🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree

Sekianlah artikel 🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree kali ini, mudah-mudahan bisa memberi manfaat untuk anda semua. baiklah, sampai jumpa di postingan artikel lainnya.

Anda sekarang membaca artikel 🚀 ETH miners are probably Pocketing Themselves a King's Ransom throughout this DeFi spree dengan alamat link https://beritaindoterkini2017.blogspot.com/2020/07/eth-miners-are-probably-pocketing.html

0 Komentar